Li.Fi Translation site

Li Finance is a cross-chain bridge aggregator that supports any-to-any swaps by aggregating bridges at the same time. LI.FI is the best cross-chain swap across all bri...

Tags:aggregating bridges blockchain tools cross-chain bridges cryptocurrency defi DEX AggregatorsLI.FI - All DEX Aggregators & Bridges - CoinNav.io

The Significance of Bridge Aggregators

As the adoption of scaling solutions like Layer 2 and Layer 1 blockchains increases, the role of bridge aggregators becomes increasingly important. Layer 2 scaling solutions build upon Layer 1 blockchains such as Ethereum, leveraging their security and decentralization. However, eventually, transactions executed on Layer 2 networks need to be transferred back to Layer 1.

In the realm of decentralized exchange (DEX) aggregators, bridge aggregators play a vital role in facilitating interactions across Layer 1, Layer 2, and even Layer 0 blockchains. However, the availability of bridge aggregators is currently limited, leaving users uncertain about which bridges offer the most favorable rates and user experiences.

Additionally, existing bridges often support only a limited range of cryptocurrencies, which creates confusion and inconvenience for users attempting to bridge smaller-cap tokens. To address these challenges and provide users with a seamless experience across different blockchain networks, the development and implementation of bridge aggregators are of utmost importance.

By bridging the gap between different blockchain networks, bridge aggregators empower users to seamlessly transfer and transact their assets, regardless of the specific blockchain or layer they are operating on. As the crypto ecosystem continues to evolve, bridge aggregators will play a pivotal role in enabling interoperability and enhancing user experiences within the expanding blockchain landscape.

Your Go-To Source for the Latest News and Tools in the Blockchain Sector - Coinnav.io

What is Li Finance?

Li Finance is an innovative cross-chain bridge aggregator that redefines the process of swapping assets across different blockchain networks. By bringing together multiple bridges and collaborating with DEX Aggregators, Li Finance offers a seamless and flexible any-to-any swapping experience.

Unlike traditional methods that often involve converting assets into stablecoins before bridging, Li Finance simplifies the process by directly connecting DEXes on both ends of the bridge. This means you can bridge a wide range of coins without the need for prior conversion, saving time and reducing complexity.

With Li Finance, you have access to multiple routes for asset bridging, enabling you to navigate through different networks effortlessly. For example, you can bridge AAVE on Polygon to DAI on Polygon using Paraswap, then further bridge DAI on Avalanche using NXTP, and finally swap to SPELL on Avalanche using Paraswap.

What sets Li Finance apart is its capability to bridge across chains, even those that are not EVM-compatible. While most bridges focus solely on EVM-compatible networks, Li Finance broadens the horizon by enabling connectivity across various chains, unlocking new possibilities for users.

To enhance the overall user experience, Li Finance offers a smooth and customizable interface through their Javascript SDK. This SDK seamlessly integrates with all wallets, ensuring a user-friendly and enjoyable bridging experience for all users.

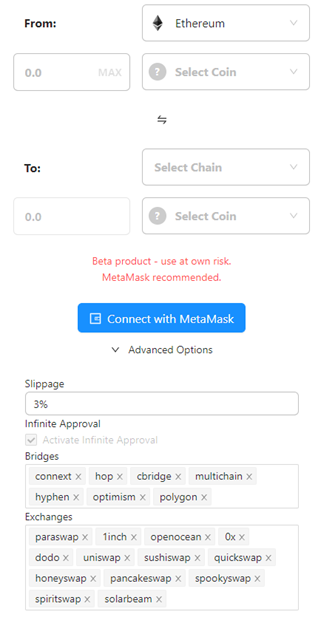

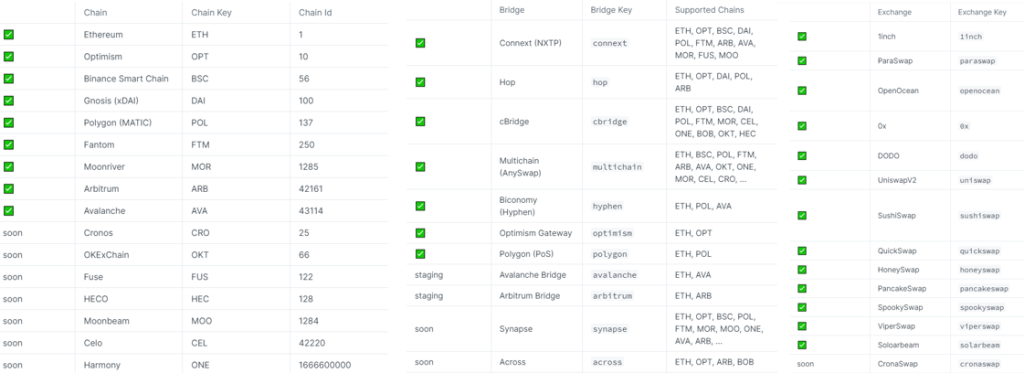

Li Finance operates on a multitude of platforms such as:

Efficient Routing, Aggregation, and Abstraction

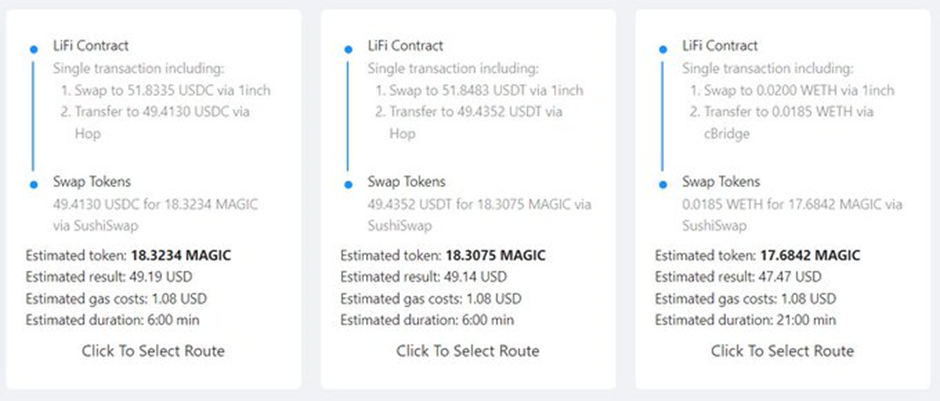

Li Finance utilizes an intelligent algorithm to identify the most optimal routes for maximizing efficiency and reducing gas costs. Presently, this smart routing occurs off-chain. Although the absence of decentralization may raise some concerns, Li Finance has future intentions to transition to a fully on-chain and transparent mechanism.

The bridge abstraction is achieved through a flexible smart contract that can be upgraded as needed. This allows for ongoing optimization as new advancements emerge. The contract enables complex swaps between various tokens, facilitating seamless transactions across different chains, including on-chain, cross-chain, and multi-chain swaps.

Use Cases of Li Finance

Li Finance provides a wide range of use cases, as described in their documentation. These use cases include:

Seamless User Onboarding: Li Finance offers a user-friendly onboarding process, ensuring a smooth entry into the ecosystem and easy interaction with the dApp interface. Cross-Chain Asset Swaps: Users can seamlessly swap assets across different chains and bridges, facilitating efficient asset transfers while avoiding potential loss of funds due to incorrect bridging. Cross-Chain Yield Farming: Li Finance supports yield farming across multiple chains, with vault contracts tracking yield generation. This empowers users to optimize their deposit strategies and select the most profitable yield-generating protocols while minimizing fees. Multi-Chain Money Markets: Li Finance enables cross-chain lending and borrowing by facilitating communication between dApps, offering loan collateralization, borrowing, and repayment options on various networks. Users can access analytics on the Li Finance website to monitor their activities.

With Li Finance, users have the flexibility to interact with the dApp interface in their preferred manner. They can select assets from any chain or bridge, swiftly swap and transfer them to desired vaults. This eliminates the risk of incorrect bridging, particularly beneficial for less experienced users to prevent fund losses.

Furthermore, Li Finance provides seamless opportunities for yield farming, as vault contracts track yield across multiple chains. Users can optimize their deposit strategies and find the most lucrative yield-generating protocols, ultimately reducing fees.

Another notable feature is the cross-chain loan functionality. Through Li Finance, dApps can communicate and enable users to collateralize, borrow, and repay loans on different networks.

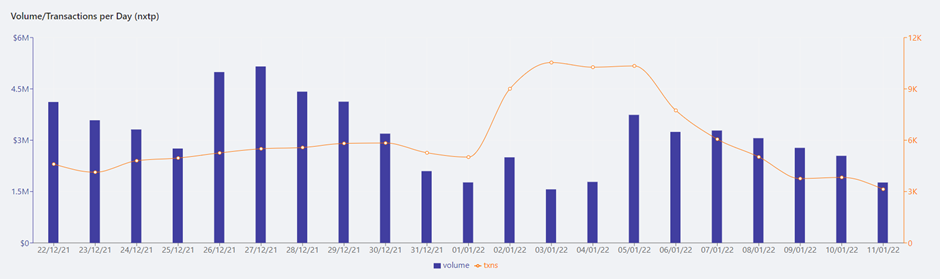

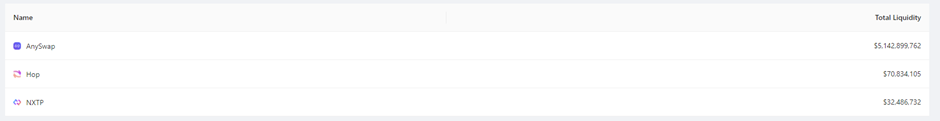

Users can access detailed analytics on the Li Finance website, including usage per route, volume/transactions per day, and liquidity per chain and token. The platform currently sources liquidity from AnySwap, Hop, and NXTP.

In conclusion

Li Finance is a standout platform offering a user-friendly interface and a wide range of tokens for bridging. Their seamless and efficient transaction processing has made bridging accessible to all users, enhancing the overall user experience.

With the decentralized finance landscape moving towards a multi-chain future, Li Finance has the potential to establish itself as a prominent aggregator in the industry. It is worth considering utilizing their bridge for at least one swap, as there may be future opportunities such as airdrops.

By staying informed about Li Finance's progress and updates, you can stay ahead in the rapidly evolving world of decentralized finance and take advantage of the opportunities it presents.