1inch Exchange Translation site

1inch is a DEX aggregator that compares exchange rates and prices across different exchanges to find the lowest cryptocurrency prices for traders.

Tags:blockchain tools crypto exchange cryptocurrency dex1inch Exchange: Start Your Crypto DEX Swaps - CoinNav.io

What is 1Inch?

In the world of decentralized exchanges (DEXs) like Uniswap, SushiSwap, and PancakeSwap, each platform operates differently and sells cryptocurrencies at slightly varying prices, creating arbitrage opportunities. This means that the price of Ethereum on Uniswap might differ from its price on 0x, not to mention the potential variance in fees charged by each platform.

Wouldn't it be great if there was a way to find the best prices across DEXs?

Fortunately, there is, and it's called 1inch Exchange.

At any given time, prices and transaction fees on decentralized exchanges can vary significantly. Instead of manually checking and comparing prices on different exchanges, 1inch collects real-time pricing data from various DEXs, allowing traders to identify the best prices across the entire market and capture trading opportunities within a single platform.

Currently, 1inch Exchange has launched more than 20 liquidity pools such as SushiSwap, Balancer, Uniswap, Curve, and Kyber Network. With 1inch Exchange, traders can unlock the potential for optimal pricing and enhanced trading experiences across multiple DEXs.

How 1inch Exchange Works

The operation of 1inch Exchange is similar to popular travel booking websites. Just as these websites aggregate prices from hundreds of airlines, hotels, and travel providers, 1inch compares cryptocurrency prices and transaction fees across multiple decentralized exchanges (DEXs).

Your Go-To Source for the Latest News and Tools in the Blockchain Sector - Coinnav.io.

Aggregation Protocol:

1inch automatically routes trades to the platform with the best prices and lowest fees, allowing traders to compare prices across the entire DEX space and execute transactions within a single platform.

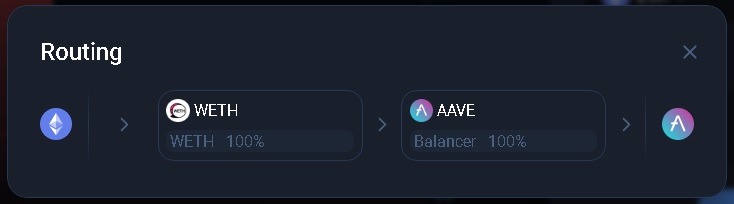

The latest development by 1inch, called Pathfinder, determines the optimal trading route across multiple markets while considering gas fees. With Pathfinder, a single trade can be broken down into smaller parts across multiple DEX platforms, providing the most price-efficient options.

For example, let's say a 1inch user wants to trade Ether with $100 worth of DAI stablecoin on the 1inch platform. 1inch may find that the user would pay the lowest fees if they first convert DAI to a different stablecoin, such as USDC, and then convert USDC to ETH.

Additionally, 1inch may discover that using the 0x exchange to convert $30 worth of DAI to ETH and using the Balancer exchange to convert $70 worth of DAI to ETH would be the most cost-effective approach. The 1inch trader still executes a single transaction without having to worry about the complex discovery and routing process happening behind the scenes.

Liquidity Protocol:

1inch's liquidity protocol was initially launched as Mooniswap, allowing users to earn passive income by depositing their crypto assets into 1inch liquidity pools. Subsequently, traders using the 1inch DEX can utilize the cryptocurrencies held in the liquidity pools as counterparties for their trades.

In return, liquidity providers earn "LP tokens," which can be staked or exchanged for other cryptocurrencies.

The 1inch liquidity protocol also incorporates a feature called virtual rates, aimed at addressing frontrunning issues. Frontrunning occurs when malicious traders, miners, or bots observe transactions broadcasted to the network and place their own trades with higher fees to be processed ahead of the observed pending transactions. The virtual rates adjust the fees within the liquidity pools, making it unprofitable for malicious actors to engage in such behavior.

Limit Order Protocol:

1inch's limit order protocol allows traders to place advanced conditional orders beyond standard swap orders. Using the limit order protocol, 1inch traders can place orders such as stop-loss orders and trailing stop orders, automatically locking in profits or preventing losses at specific price points.

1inch exchange fees

As a DEX aggregator, 1inch Exchange does not charge any additional fees for token swaps. Instead, the fees incurred during swaps depend on the decentralized exchanges from which liquidity is sourced.

For instance, Uniswap implements trading fees ranging from 0.01% to 1.00%, varying based on the trading pair, while Balancer has variable fees based on the specific pool.

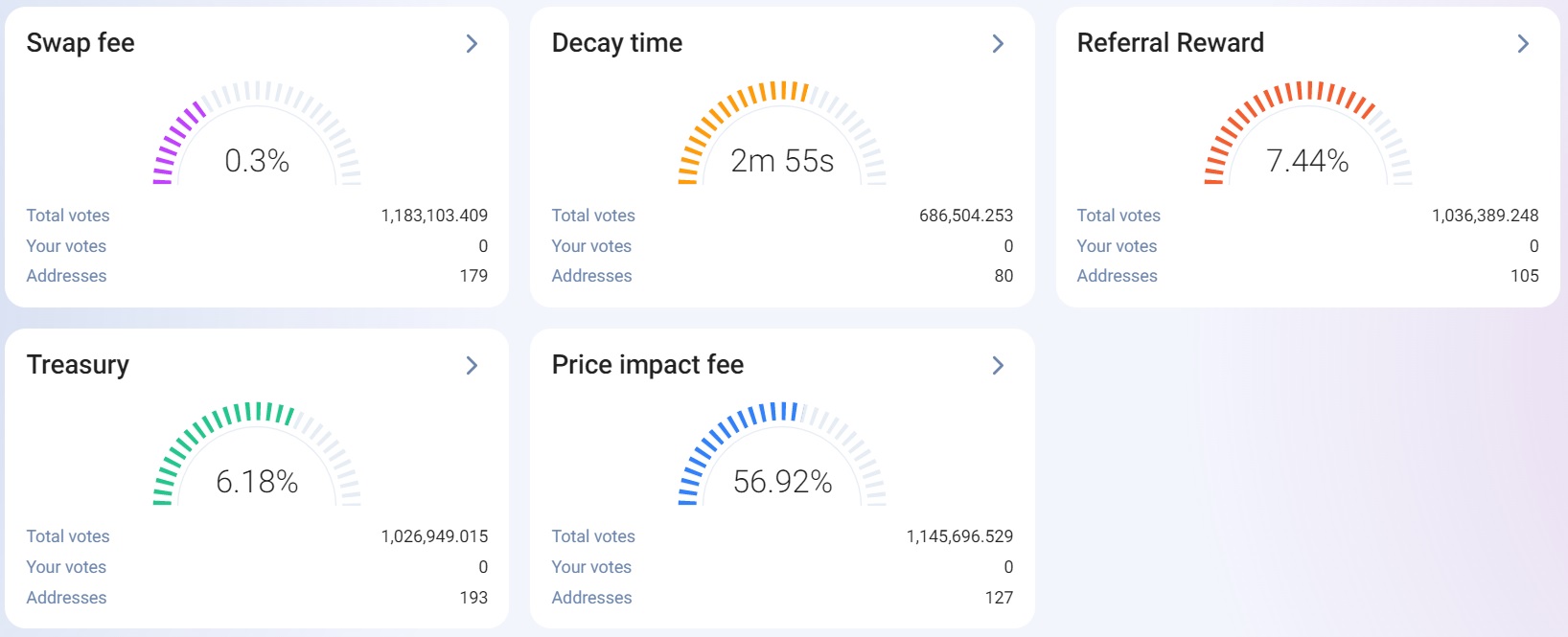

1inch's liquidity protocol currently imposes a swap fee of 0.30%, which is determined by 1inch token holders and subject to change.

According to 1inch's published article, trading fees, which can vary across different decentralized exchanges, are already factored into the swap rate provided.

To explore fees associated with other decentralized exchanges, you can refer to a list specifically curated for such purposes.

The native token of the 1inch Network, 1INCH, serves as a governance token, and the platform heavily relies on its decentralized autonomous organization (DAO) for determining fees and rewards.

By accessing the "DAO" tab on the platform, you can review the swap fee for the liquidity protocol, governance rewards, and other related parameters, as well as participate in governance decisions.

If you stake your 1INCH tokens or provide liquidity to the protocol, you gain the ability to influence major protocol parameters.

You may wonder how 1inch Exchange generates revenue if it does not charge direct fees for swaps. The platform receives a portion of the fees that liquidity sources, with which it partners, earn. Additionally, it previously earned from positive slippage, although a portion of these earnings will now be allocated to referrers, while the remainder will contribute to the governance reward pool.

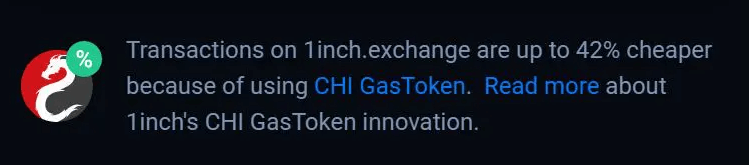

In the realm of decentralized exchanges, the focus today often revolves around gas fees. Due to congestion on the Ethereum network, transaction fees can be high at times.

To alleviate this burden, you have the option to activate Chi Gastoken on the platform, reducing your transaction costs. Alternatively, you can optimize your trades by executing them during periods of low Ethereum gas prices.

What is 1INCH token?

The 1INCH token is an ERC-20 token that serves as the core element for managing liquidity pools and the DEX aggregation functionality within the 1inch Exchange platform.

These tokens facilitate various functions within the protocol, including payment of swap fees, price impact fees, and governance rewards for stakers.

1INCH token serves both as a utility token and a governance token. As a governance token, it enables token holders to participate in decision-making processes and governance activities on the network protocol. Holders of the token are eligible to receive governance rewards, which are directly distributed to their wallets.

You can access the current parameters and actively engage in governance activities under the "DAO" tab on the platform.

The total supply of 1INCH tokens is 1.5 billion tokens. Out of this total supply, 30% of the 1INCH token supply has been allocated to the community and will be distributed over a period of four years.

The remaining supply of 1INCH tokens will gradually be allocated to the team, investors, and other stakeholders, with 14.5% of the supply reserved for development purposes, ensuring continued enhancement of the platform.

How to Purchase 1INCH Token?

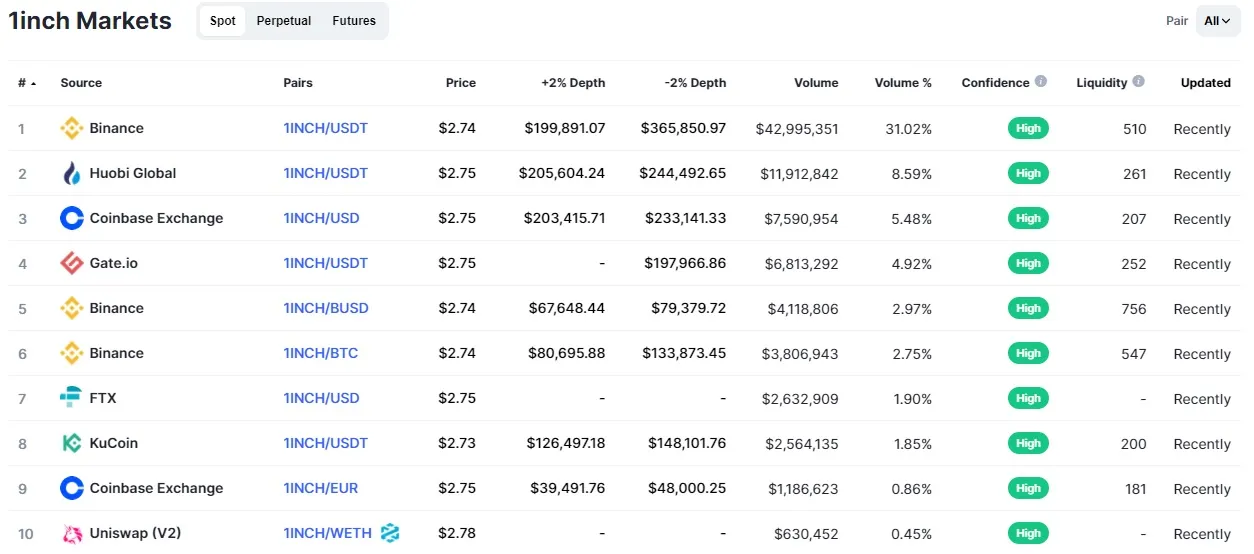

To acquire 1INCH tokens, you have several options available. Firstly, major cryptocurrency exchanges such as Binance, KuCoin, Huobi Global, FTX, and OKEx support the trading of 1INCH tokens. Binance, in particular, offers the largest market for trading 1INCH against Bitcoin, while the 1inch exchange itself serves as the largest market for Tether trading.

If you choose to buy 1INCH tokens on an exchange like Binance, you will need to load your wallet with the corresponding cryptocurrency that is paired with 1INCH, such as USDT (Tether), BUSD, or Bitcoin. Once your wallet is funded, you can proceed to the appropriate trading pair page on the exchange to exchange it for 1INCH. Alternatively, if you prefer to use the 1inch exchange, you can follow the guide provided above for instructions on how to purchase 1INCH tokens directly on the platform.

About Chi GasToken

Following its debut in the "Hack Money" event within the DeFi space in May 2020, 1inch Exchange launched Chi Gastoken, also known as "Chi," in June 2020. Chi Gastoken is an ERC-20 token designed to offset transaction fees on the 1inch Exchange.

The primary purpose of introducing this token was to help users of the exchange save on Ethereum gas fees. It is claimed that CHI Gastoken can offer gas savings of up to 42%. Gas fees are similar to the charges imposed by banks for cash transactions. However, as network congestion increases, gas fees also rise. This means that higher network traffic results in higher gas fees.

The price of CHI is correlated with the price of Ethereum gas. Consequently, an increase in gas prices would lead to a corresponding increase in the cost of CHI. Due to market fluctuations, it is challenging to provide an exact estimation or predict the precise scale of gas fees.

While similar to GasToken (GST2), CHI has some improvements. Mining CHI allows for a 1% commission savings compared to mining GasToken (GST2). Additionally, burning or selling CHI offers a 10% savings compared to selling GST2.

How to Use 1inch Exchange?

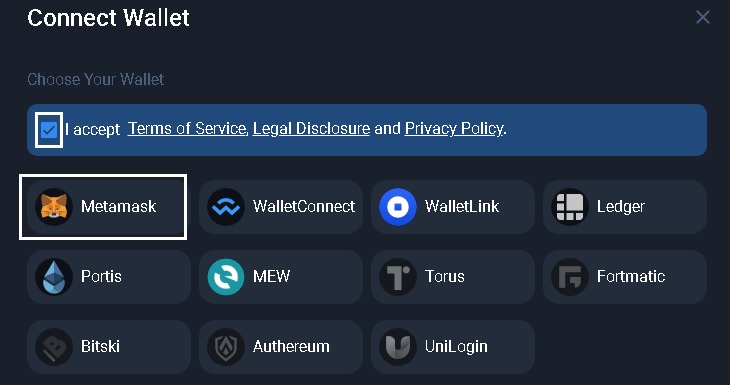

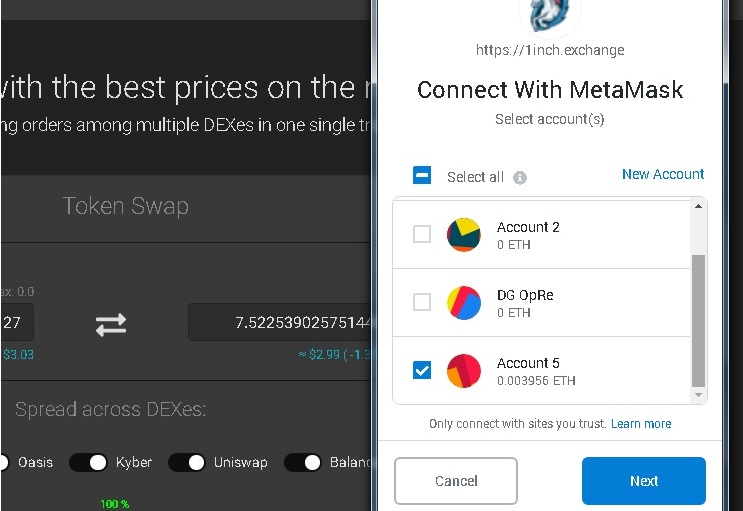

- Step 1: Open your wallet and connect it to 1inch Exchange

To begin, open your browser-based Ethereum wallet and connect it to the main trading page of 1inch Exchange. We will use MetaMask as an example, although other products are also available.

Access the 1inch Exchange and click on the "Connect Wallet" button located in the top right corner of the page. Accept the terms and click on MetaMask.

If 1inch does not detect MetaMask, it may be recognized as a Web3 wallet. In that case, you can refresh the page.

- Step 2: Confirm the connection on MetaMask

When you click "MetaMask" on 1inch Exchange, a notification will pop up on your MetaMask wallet for confirmation.

Simply select the address you want to use and connect your wallet to 1inch Exchange through the MetaMask notification.

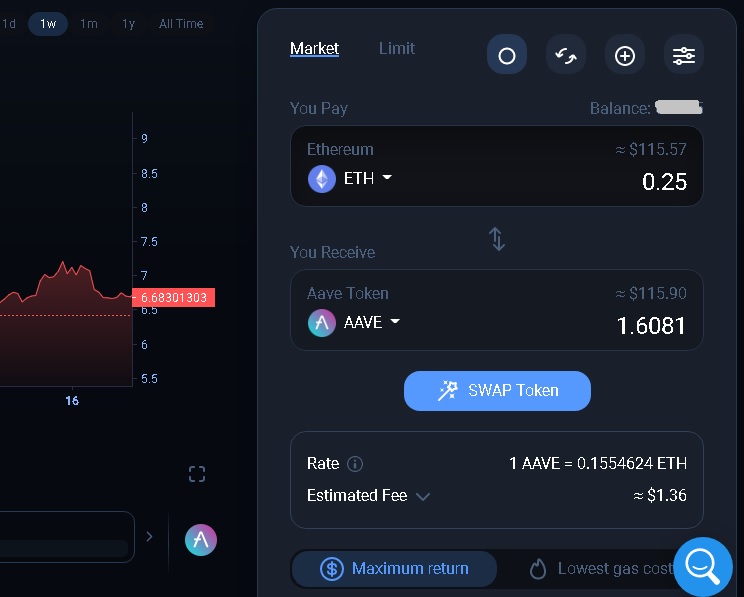

- Step 3: Exchange tokens on 1inchExchange

Start by selecting the token you want to exchange and enter the quantity. Then choose the currency you want to exchange it for. In the example below, I will be swapping Ethereum for AAVE.

If you haven't done so before, you will need to unlock the token you want to exchange before proceeding with the swap. In the example below, Ethereum is unlocked since I had previously unlocked it and there is no lock icon.

This order will use Balancer, which offers the best price currently available. Sometimes an order may be allocated across multiple decentralized exchanges to achieve the optimal exchange rate.

You can customize the gas fee by clicking on the settings icon or use Chi Gastoken to pay lower gas fees. To learn how to use Chi Gastoken, you can refer to the provided article.

If you don't want your transaction to fail due to price fluctuations, you can increase the price slippage tolerance. To execute the swap, click on the "Swap Tokens" button and confirm the transaction on MetaMask.

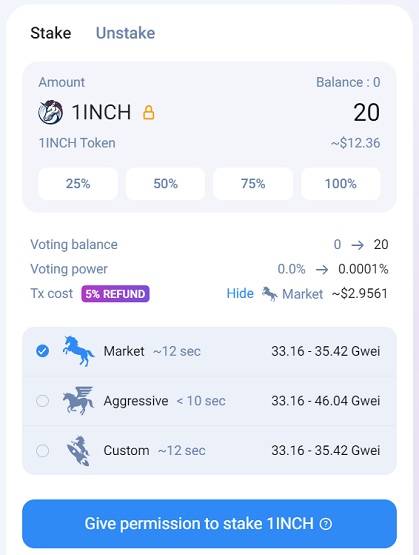

How to Participate in 1inch Token Staking

To stake your 1inch tokens, navigate to the "Staking" page, which can be accessed through the "DAO" menu on the platform.

By staking your 1inch tokens, you can enjoy benefits such as receiving up to 95% of gas expenses refunded in the form of 1INCH tokens and actively participating in the governance of the protocol.

As a 1inch token staker, you have the opportunity to vote on various parameters related to liquidity and aggregation protocols, including the swap fee and governance reward (treasury).

To begin staking, follow these steps:

- Visit the 1inch exchange platform and click on the "Connect Wallet" button to connect your wallet to the platform.

- After connecting your wallet, access the "Staking" page through the DAO menu.

- Enter the desired amount of 1INCH tokens that you wish to stake.

- Click on the permission button to grant the smart contract permission to utilize your 1INCH tokens.

- Once you have approved the permission transaction on your wallet, you can proceed to stake your 1INCH tokens.

Additionally, you have the option to customize the gas fee by setting a custom value or selecting the "aggressive" option, depending on your preference for transaction fees and the desired speed of transaction completion.