Uniswap Translation site

A beginner's guide to the popular DEX on the Ethereum blockchain. Uniswap allows users anywhere in the world to trade crypto without an intermediary.

Tags:blockchain tools crypto exchange cryptocurrency dexUniswap | CoinNav- Blockchain Crypto Exchange Starts Here

A beginner's guide to the popular DEX on the Ethereum blockchain. Uniswap allows users anywhere in the world to trade crypto without an intermediary.

Uniswap VS Traditional Centralized Exchanges

Uniswap, one of the pioneer decentralized finance (DeFi) applications, gained significant attention upon its launch on the Ethereum network in November 2018. Since then, many other decentralized exchanges have emerged (including Curve, SushiSwap, and Balancer), but Uniswap remains the most prominent and widely used decentralized exchange. According to the latest data, Uniswap currently ranks as the fourth largest decentralized finance (DeFi) platform, with over $3 billion worth of crypto assets locked in its protocol.

On the other hand, Uniswap is entirely open-source, allowing anyone to replicate the code and create their own decentralized exchange. It even enables users to list tokens in exchange for free. This stands in stark contrast to traditional centralized exchanges that operate for profit and charge significant fees for listing new coins. Being a decentralized exchange (DEX), Uniswap ensures users retain control over their funds at all times, unlike centralized exchanges such as Coinbase and Binance that require traders to relinquish control of their private keys for orders to be recorded in internal databases, which can be time-consuming and costly. By maintaining control over their private keys, users eliminate the risk of losing assets in the event of exchange hacks.

The majority of cryptocurrency trading occurs on centralized exchanges such as Coinbase and Binance. These platforms are managed by single entities (the companies operating the exchanges), requiring users to entrust their funds under their control and utilize traditional order book systems to facilitate trades.

Order book-based trading refers to the display of buy and sells orders along with the total amount for each order in a list. The number of outstanding buy and sell orders for an asset is known as the "market depth." For successful trades within this system, a buy order must match with a sell order on the opposite side of the order book, at the same quantity and price, and vice versa.

How Uniswap works

Uniswap runs on two smart contracts; an “Exchange” contract and a “Factory” contract. These are automatic computer programs that are designed to perform specific functions when certain conditions are met. In this instance, the factory smart contract is used to add new tokens to the platform and the exchange contract facilitates all token swaps, or “trades.” Any ERC20-based token can be swapped with another on the updated Uniswap v.2 platforms.

Your Go-To Source for the Latest News and Tools in the Blockchain Sector - Coinnav.io.

Automated liquidity protocol

Uniswap addresses the liquidity challenges faced by centralized exchanges through its automated liquidity protocol. This protocol incentivizes users to become liquidity providers (LPs) by pooling their funds on the platform. The pooled funds are utilized to facilitate all trades conducted on Uniswap. Each listed token has its own pool, and the token prices are determined by a mathematical algorithm executed by a computer.

This system enables buyers and sellers to execute trades instantly at a known price, without the need for counterparties. As long as there is sufficient liquidity in the relevant pool, trades can be completed seamlessly. In return for providing liquidity, LPs receive tokens representing their stake in the pool. For example, if an LP contributes $10,000 to a pool with a total value of $100,000, it would receive a token representing a 10% stake in that pool. These LP tokens can be redeemed for a share of the trading fees.

Uniswap charges users a flat 0.30% fee for each trade, which is automatically directed to a liquidity reserve. When an LP decides to withdraw its liquidity, they receive a portion of the total fees from the reserve proportional to its stake in the pool. The LP token they received, which records their stake, is then destroyed.

Following the Uniswap v.2 upgrades, a new protocol fee was introduced. This fee, which can be enabled or disabled through a community vote, allocates 0.05% of the 0.30% trading fee to a Uniswap fund, intended to finance future development. Currently, this fee option is turned off. However, if activated, LPs will start receiving 0.25% of the trading fees collected by their respective pools.

Determining Token Price

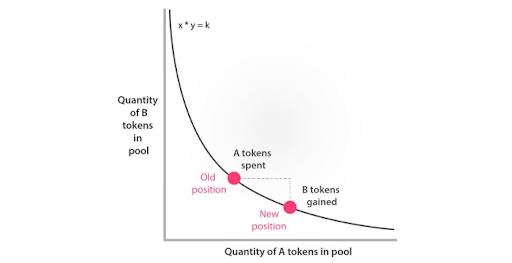

The process of determining the price of each token on Uniswap differs from traditional order book systems. Instead of relying on the highest buyer and lowest seller, Uniswap utilizes an automated market-maker system. This system adjusts the price of an asset based on its supply and demand using a mathematical equation that has been in use for a long time. The equation, represented as x * y = k, takes into account the amounts of two tokens, A and B, in the pool, with k being a constant value.

To start a liquidity pool for a new ERC-20 token on Uniswap, a certain amount of the chosen token and an equal amount of another ERC-20 token must be added. The equation then calculates the price of each token based on the changing ratio of the tokens in the pool. For example, when someone adds a large amount of LINK (Chainlink) to the LINK/ETH pool, the ratio of LINK to ETH in the pool increases. As the value of k remains constant, the cost of ETH increases while the cost of LINK in the pool decreases. Therefore, the more LINK added, the less ETH is obtained in return due to the increased price of ETH.

The size of the liquidity pool also plays a role in determining how much the token price will change during a trade. A larger pool with more liquidity enables larger trades to occur without significant price slippage.

Arbitrage

Arbitrage traders play a vital role in the Uniswap ecosystem. These traders specialize in identifying price discrepancies across multiple exchanges and capitalize on them to make profits. For instance, if Bitcoin is trading at $35,500 on Kraken and $35,450 on Binance, an arbitrage trader can buy Bitcoin on Binance and sell it on Kraken to secure a risk-free profit.

On Uniswap, arbitrage traders identify tokens that are trading above or below their average market price due to imbalances created by significant trades. They buy or sell these tokens accordingly until the price is rebalanced in line with other exchanges, eliminating the opportunity for further profit. This symbiotic relationship between the automated market maker system and arbitrage traders ensures that Uniswap token prices align with the broader market.

How to Use Uniswap

To get started with Uniswap, you'll need to ensure that you have already set up an ERC-20 supported wallet such as MetaMask, WalletConnect, Coinbase wallet, Portis, or Fortmatic.

Once you have a compatible wallet, follow these steps to use Uniswap:

- Visit the Uniswap website at https://uniswap.org.

- Click on the "Use Uniswap" button located in the top right-hand corner of the page.

- Click on "Connect wallet" also located in the top right-hand corner and select your wallet from the options provided.

- Log into your wallet and authorize the connection to Uniswap.

- On the screen, you will see the option to swap tokens directly. Use the drop-down menus next to the "from" and "to" sections to select the tokens you wish to swap.

- Enter the amount of tokens you want to swap and click on the "swap" button.

- A preview window will appear, displaying the details of the transaction. Confirm the transaction on your ERC-20 wallet.

- Wait for the transaction to be processed and added to the Ethereum blockchain. You can track its progress by copying and pasting the transaction ID into https://etherscan.io/. The transaction ID can be found in your wallet's transaction history.

It's important to note that when using Uniswap, you will need to have enough ether in your wallet to cover the transaction fees, also known as gas fees. The speed of your transaction can be adjusted by choosing the appropriate gas fee option provided by your wallet, with slower options being cheaper and faster options being more expensive.

By following these steps, you can easily utilize Uniswap to swap tokens and participate in decentralized trading on the Ethereum blockchain.

What is UNI?

The UNI token, the native token of Uniswap, is known as a governance token. This provides holders with the ability to vote on new developments and changes to the platform, including how newly minted tokens are allocated to the community and developers, as well as any changes to the fee structure.

The UNI token was initially created in September 2020 as a response to prevent users from migrating to the competing DEX, SushiSwap. It adopted a unique distribution method, airdropping 400 UNI tokens to every Ethereum address that had interacted with the protocol. Over 250,000 Ethereum addresses received the airdrop, which was valued at nearly $1,400 at the time. Since then, airdrops have become a popular way for DeFi applications to reward long-term users, and Uniswap has plans to distribute a total of 1 billion UNI tokens over a four-year period.

The Uniswap Dilemma: Overcoming Challenges

In the fast-paced and highly competitive decentralized finance (DeFi) industry, staying at the forefront is a constant challenge. Uniswap, once popular, can quickly lose its spotlight to rival protocols in the blink of an eye.

As mentioned earlier, Ethereum, the blockchain on which Uniswap operates, is grappling with congestion issues caused by the surge in DeFi projects. Consequently, gas prices have skyrocketed, creating a pressing need for Ethereum 2.0 to be implemented swiftly. Failure to address this concern could lead the industry to explore alternative blockchains, posing a potential threat to Uniswap's position.

Critics also point out Uniswap's heavy reliance on arbitrage trading, suggesting that the platform's long-term success hinges on centralized exchanges like Binance and Coinbase. This dependence poses a risk to Uniswap's autonomy and decentralized nature.

However, Uniswap is not one to rest on its laurels. The team is actively working on upgrading to Version 3 (V3) in a bid to stay ahead. Founder Hayden Adams has boldly claimed that this forthcoming version will outshine its predecessor, offering a significantly enhanced user experience. It is this commitment to innovation that could help Uniswap maintain its competitive edge amidst the ever-evolving DeFi landscape.